-

1. Management Report 2021

- 1.1 In two minutes

- 1.2 Strategy and value creation

- 1.3 Ferrovial in 2021

- 1.4 Risks

- 1.5 Corporate Governance

- 1.6 Expected Business Performance in 2022

-

Appendix

- Alternative Performance Measures

- Sustainability Management

- Reporting Principles

- European Taxonomy

- Task Force on Climate Related Disclosures

- Scoreboard

- Contents of Non-Financial Information Statements

- SASB Indicators

- GRI Standard Indicators

- Appendix to GRI Standards Indicators

- Glosary of Terms

- Verification Report

-

2. Consolidated Financial Statements 2021

- Consolidated Financial Statements

- Audit Report

BUSINESS LINES

Services (discontinued operations)

Ferrovial carried out significant advances in the Services divestment process during 2021. Besides the first milestone reached with the sale of Broadspectrum in 2020, in 2021, Ferrovial completed the sale of the environmental activity in Spain & Portugal to PreZero International GmbH (Group Schwarz) for an equility value of EUR1,032mn. The deal provides a capital gain of EUR335mn.

Also during during 2021, Ferrovial has closed the sale of its activity related to oil&gas in USA (Timec) to Architech Equity Holdings for EUR16mn. The activity related to infrastructure maintenance services in US is now included in the Construction perimeter.

On January 31st, 2022, Ferrovial completed the sale of infrastructure Services business in Spain to Portobello Capital for EUR171mn. This price does not include the earn-outs, valued at EUR50mn, which will be applied after the closing of the transaction based on the fulfillment of certain requirements set forth in the share purchase agreement. In addition to the price received from the operation, Ferrovial retains on its balance sheet the cash generated from December 31st, 2020 and until the closing of the transaction, which is estimated at EUR60mn. After the closing of the sale, Ferrovial has acquired 24.99% of the share capital of the acquiring entity for EUR17mn.

In line with Ferrovial’s commitment to divest Services, the division has been classified as “held for sale” however, in order to provide an analysis of the division, the main figures of the Services results are detailed below, excluding the Environmental Services activity in Spain already sold and excluded form the results.

2021 revenues by activity & change LfL vs 2020:

In 2021, revenues increased by +9.0% LfL and EBITDA reached EUR365mn (+78.0% LfL vs 2020).

In 2021, the performance of the activities have not been divested and remain as discontinued activities was as follows:

UK: Revenues increased by +9.5% LfL mainly due to new road contracts in the Transport area and higher activity in Rail and Maintenance with the Ministries of Defense and Justice. Profitability was also positively impacted with EBITDA increasing +116.8% LfL, with an EBITDA margin of 4.5% vs 1.7% in 2020.

Chile: Revenues increased by +18.1% LfL on the back of the the start of new mining maintenance contracts in the last months of 2020. EBITDA increased by +68.5% LfL on the back of higher activity, reaching an EBITDA margin of 9.8% vs. 5.8% in 2020.

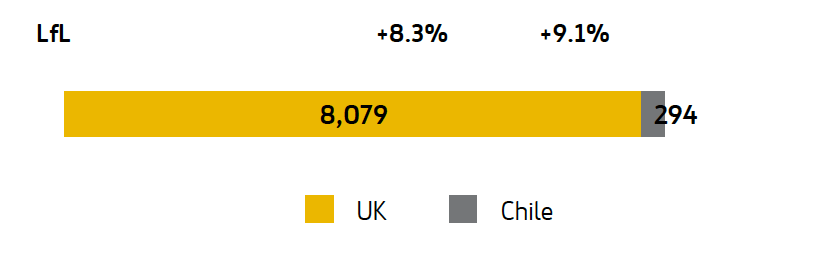

The Services order book of the activities that remain as discontinued activities reached EUR8,373mn, increasing by +8.3% LfL vs December 2020 (EUR8,293mn).

2021 Order book & LfL change vs December 2020:

DISCONTINUED OPERATIONS

Ferrovial classified all of its services activities as “discontinued operations” as of 31 December 2018. In accordance with IFRS 5, the classification of the Services business activities to discontinued operations continues at the date of this report.

The result from Services discontinued operations stood at EUR246mn, which mainly includes the impact from the divestments of the Environmental activity in Spain & Portugal (EUR335mn).

The Waste Treatment activity in UK has been reclassified as continuing activity in 2021, the comparable information for 2020 has been restated, in accordance with the provisions of IFRS5. Although Ferrovial will continue with its divestment process in the future, it is foreseeable that it will take longer than 12 months since one plant is reaching construction end and others are increasing availability in the following months.

In addition, it has been excluded from the scope of Services sale, the contract for the conservation and operation of the section of the A2 highway (Aravia) which is remunerated as a shadow toll concession, along with EMESA, the maintenance contract of the M-30 road in Madrid, both have been reclassified to continuing operations in the Toll Roads Division, together with the infrastructure maintenance business in US, Siemsa and the Spanish energy efficiency contracts also reclassified as continuing operations in the Construction Division.